BLOG

September 15th, 2015

Via China Water Risk, an interesting report on China Water-nomics and whether China’s water caps & efficiency targets will impact its economic growth:

Highlights

-Water use quotas & policies caps GDP growth at 5.7% p.a. between 2020-2030 towards South Korea by 2050

-Economic mix helps the G20 manage water & GDP; but so does trade & shifting output to match water availability

-Food and energy trade-offs leads to non-intuitive findings which could see cotton & coal head for a clash for water

Water impacts economics. The very existence of the Three Red Lines signals that China can’t keep developing the way it has. China can adopt several approaches to further develop its economy while limiting its water use. As discussed in the report, these include the adjustment of its economic mix as well as better management of virtual water flows by managing water embedded in traded goods. In particular, the report explores the case of coal and cotton, two commodities highly exposed to water stress in China.

Here are our favourite charts and map on China water-nomics:

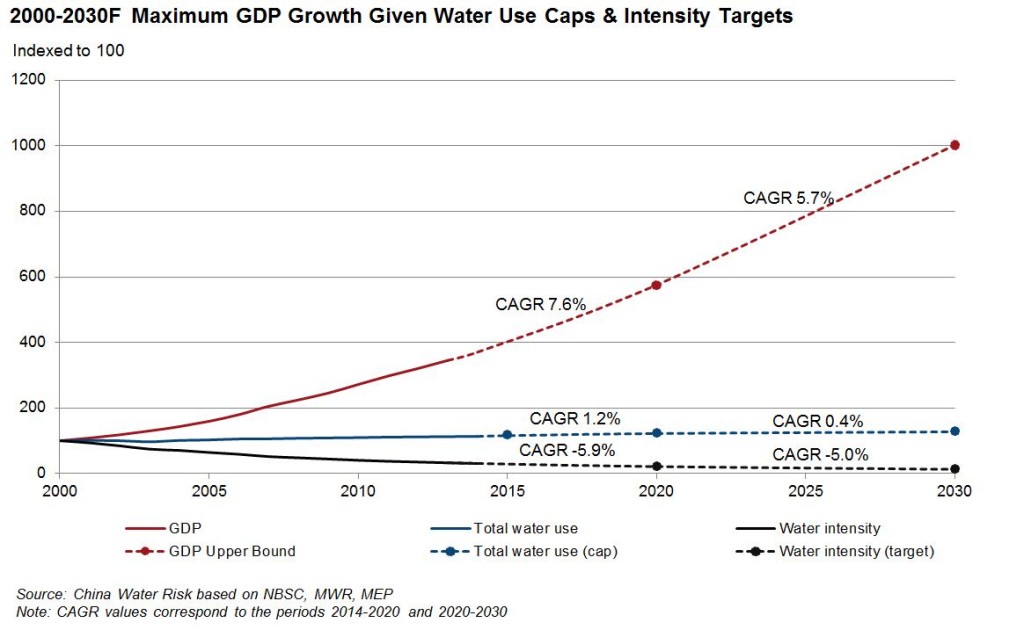

Water caps limit China GDP CAGR to 5.7% from 2020 to 2030

Water intensity (i.e. water use per unit of GDP) targets have been set out for 2020 and indicative values have also been proposed for 2030. Based on these intensity targets, we estimated that the water use quotas set an upper bound of 7.6% of annual growth between 2014 and 2020, and 5.7% between 2020 and 2030.

China’s development path on track to be South Korea by 2050

Projection of China’s economic development trajectory anticipates that in 2050, China’s GDP per capita will be similar to that of South Korea’s in 2005. Furthermore, if China was to stick with its 700 billion m3 of total water use by then, this would mean an even lower water use per capita by then.

Outsourcing water use can help develop an economy with limited water resources

Some developed countries such as Japan, France, Germany and the UK have succeeded to develop with limited water resources. A closer look shows that this has been made possible by outsourcing part of its water use through higher external water footprints.

After adjusting for the higher external water footprint, the report shows a stronger correlation between water and GDP and warns that China needs to look beyond water efficiencies to manage water resources. This includes optimizing industrial and crop mix, importing water intensive goods as well as shifting output within China to match local water resource availability.

In this transition, China will face important trade-offs between water, energy and food security.

Food & energy face-offs in China leads to non-intuitive findings

Important face-offs in food & energy loom as shown in the map below.

The North China Plain (NCP) (approximated here as Hebei, Henan, Shandong and Jiangsu) exemplifies these tensions. With only 4% of China’s internal renewable resources, the NCP provides more than a quarter of the national grain output and 12% of its extracted coal. Moreover, almost a third of NCP’s water use comes from groundwater while the national average is 18%. As a result, the water situation in this region is dire: groundwater depletion, drying rivers, pollution both of groundwater & surface water and salinization.

Why is the parched North China Plain growing 25% of China’s cotton output?

Given that cotton is inedible, will it be the first to move out of the NCP? This question is especially pertinent since cotton is dirty and thirsty and 25% of China’s cotton is grown in this region. Are the current planned policies of shifting cotton production from the NCP to Xinjiang a sustainable path? HSBC explores this in the report and warns that cotton’s high exposure to China is high – read HSBC’s opinion here.

Investors and businesses – Risk of being blindsided by non-intuitive findings are high

As warned by HSBC, cotton’s water footprint in the NCP is equivalent to the water transferred by Phase 1 of the Middle Route of the South-to-North Water Diversion Project. These non-intuitive findings mean that the risk of businesses and investors being blindsided by trade-offs made to ensure water, food and energy security are high.

“one thing is clear: risks are clearly shifting beyond CSR for the textile & apparel sector”

For the textile and apparel sector, issues highlighted in HSBC’s report pertaining to cotton is just the start – China exposure across other key fashion materials is also high, from wool to synthetic fibres, there is no escape – more here.

Agricultural and water policies are changing in China, creating uncertainty. But one thing is clear: risks are clearly shifting beyond CSR for the textile & apparel sector.