In 2023 the United Nations’ authority on water warned that a global water crisis was imminent. For many communities, this crisis is already upon them, with water shortages affecting over a third of the world’s population, and many others dealing with devastating floods caused by climate change. The UN predicts the situation will get significantly worse over the coming years, setting the stage for an explosion of conflicts.1

These emerging ‘water wars’ are largely about agriculture. Farming accounts for roughly 70% of global water consumption, and many of the world’s most important agricultural zones are running out of water, squeezed by the depletion of aquifers and droughts exacerbated by climate change and deforestation.2 Most of today’s conflicts over water, and those to come, pit the interests of agribusiness against those of small-scale food producers, local communities and even urban neighbourhoods.

Some see an opportunity in this crisis. The more rare and valuable water becomes, the more lucrative it can be to those who possess it. And this potential for profit has not escaped the attention of actors in the financial sector who thrive on such possibilities.

In our work monitoring the global farmland grab, we have seen a growing number of cases in which financial companies buy control over key sources of water for agricultural production. These are often the same players that began buying up large areas of farmland in the aftermath of the food and financial crisis of 2008. They include pension funds, sovereign wealth funds, asset managers, insurance companies, university endowments and development banks (see Table 1). Some invest through specialised private equity funds; others are buying up access to water directly.

Water has always been a major part of the equation when it comes to farmland grabbing.3 But we are seeing more cases, recently, where access to water is what drives the interest of financial players, much more so than access to land. In most of these cases, they acquire or rent parcels of land that provide abundant and often unrestricted access to water for irrigation. The companies then grow water-intensive crops that fetch high prices in export markets. Unlike farmland deals involving thousands of hectares, in these cases the land area can be relatively small (often just a few hundred hectares). This appears to be one of the motivations, as it helps avoid accusations of land grabbing, even if the consequences of water grabbing can be equally severe for local communities.

Another feature of these deals is that they tend to be in places where water is already scarce or depleted, and where the kind of water guzzling agriculture the companies pursue has little chance of lasting beyond a couple decades. The investors are not building farms for the long-term, but something more akin to an oil well that extracts as much as possible until the resource is depleted. The financial players, who typically plan to exit within 10 to 15 years, don’t seem to care as long as they can make profits in the meantime. Nor do they seem put off by conflicts these deals generate with those who rely on the same sources of water.

A Canadian pension fund dives deep into water conflicts

One outfit leading this scramble for water is PSP Investments, a pension manager for Canadian public workers that has been an avid buyer of global farmland during the past decade.

In May 2022, PSP spent USD90 million to acquire a 500 ha blueberry farm in Olmos, Peru, that is part of one of the largest private-public irrigation schemes in the world.4 The scheme, which brings water by tunnel to this dry area of the Pacific coast from a river in the Andes mountains, was initially supposed to provide irrigation to the peasant community of Santo Domingo de Olmos. This did not happen. Instead, the government, through a decree, allocated all of the community’s 111,656 ha of land to the project without consultation, and then contracted it out to the Brazilian engineering firm Odebrecht, through a highly corrupt process. The irrigation works focused almost exclusively on a 38,000 ha block of land divided into lots of 500 ha or 1,000 ha, which Odebrecht then sold to a handful of Peruvian and foreign companies, with Odebrecht pocketing millions of dollars in the process.5

The Olmos project cost the Peruvian government over USD180 million in public expenditures but did not do what it initially claimed it would: bring water to the local people. They were displaced from the irrigated areas, and the towns where they and the farm workers live still lack access to safe drinking water. Nearly all of the water now piped in from the Andes goes to irrigate the newly established corporate farms, which grow avocados, blueberries and other water-thirsty crops that reap high prices overseas. The publicly-funded project has had few benefits for the public, but has created a fountain of profits for PSP and the other corporations that now get unrestricted and free access to water.6

The Olmos farm is just one of a growing number of farms that PSP has recently bought up or invested in around the world that provide it with control over water sources in places where there is well-established export production of high-value agricultural commodities. This includes nut plantations in Australia and California, greenhouses in Canada, fruit orchards in Maui, dairy farms in New Zealand and berry farms on every continent (see Table 2). PSP did not respond to our requests for an interview.

Leaving communities in the dust

In southwestern Spain, PSP has a hand in a water conflict playing out in another key centre of export agriculture. A two-decade long boom in the production of berries around the city of Huelva has badly depleted the aquifers that feed the wetlands of Doñana – a UNESCO world heritage site and a critical stopover point for birds migrating between Africa and Europe. Climate change and droughts have exacerbated the situation over the past few years, but the Spanish authorities and the powerful berry exporters have long known about the impending water crisis and nevertheless pushed for more growth. Huelva now produces 98% of Spain’s strawberries, with 80% of production exported outside of the country. Much like in Peru, berry farming is enormously profitable in Huelva because of an abundance of sunshine, access to poorly paid migrant labourers and, most importantly, free water from wells tapped into the aquifers.8

While the water crisis in Huelva has become a political scandal at the national and international levels, it has not dampened the flow of money into the area’s berry farms. To the contrary, over the past few years, an increasing number of financial players have bought into the region’s top berry producers. This includes PSP Investments via Hortifrut, which became the largest blueberry farmer in Huelva through the acquisition of 400 ha of farms in 2021. It also includes the European private equity firm Alantra, which has channeled Spanish and European development bank money into the acquisition of Huelva’s largest strawberry producer, Surexport.9 While these companies lobby for costly and controversial public infrastructure projects to transfer water from other drought-affected parts of Spain to save their industry, many of them are expanding to new frontiers where water sources have yet to be depleted, such as Morocco.

Hortifrut and Surexport are among the main companies now expanding berry production in Morocco. Others include Elite Agro of the UAE and the Costa Group, an Australian company that has been aggressively expanding overseas because of water-scarcity issues that it has contributed to in its home country.10 Costa’s minority shareholder, the US-based private equity firm Paine Schwartz, made a take-over bid for the company in July this year that will help fuel this expansion.11

Export fruit production in Morocco has surged in recent years on the back of this foreign investment, more than doubling in value since 2016.12 The majority of that expansion has been in berries and other water-thirsty crops, which is straining the country’s already depleted and drought-affected water resources. The grandiose expansion plans of the berry companies contrast sharply with the country’s bleak water outlook.

A decade and a half of government policies to encourage irrigation and foreign investment, including significant public subsidies and expenditures on public-private partnerships for irrigation infrastructure, have fuelled the current water crisis in Morocco. As the industrial farms rapidly depleted the dams and aquifers, the government responded by cutting off access to others and privileging the farms producing for export, many of which are connected to and, in some cases, owned by the royal family and other elites. Industrial agriculture now accounts for 85% of total national water consumption.

The consequences are catastrophic for the country’s small farmers and herders. “There’s nothing left for us,” says Lehsein, a smallholder farmer from the Chtouka province. He says small farmers have no choice but to try and sell their livestock and lands or seek work under miserable conditions on the industrial farms in their areas, or even in Spain.13

The water crisis became so dire last year that the government was forced into a u-turn on its subsidy policy. But many in Morocco have little faith that this measure will make a difference. “Firstly, because there will always be investors who can afford to set up shop on our lands without the help of subsidies,” says Salima Belemkaddem of Maroc Environnement 2050 collective. “But above all, it is because the large farms that practice this intensive water-thirsty style of agriculture already exist, and those farms alone are enough to dry everything up.”14

“The biggest players in water that you’ve never heard of”

It may seem counterintuitive for companies to make agricultural investments in places where access to water is disappearing. But this is not the case for financial companies that generally make investments with a 10 to 15 year timeframe in mind.

In California’s San Joaquin Valley, for instance, money from PSP and other financial companies has fuelled a massive boom in water-thirsty almond production in parts of the state where the aquifers are at desperately low levels. A Bloomberg investigation found that, as the water crisis in the area has become more critical and local communities and small farmers are unable to access water, financial companies have swooped in, buying up lands and digging deeper and deeper wells, with ever greater capacity to pump water from depleted aquifers. Between 2019-2022, one of every six of the deepest wells in California’s San Joaquin Valley was drilled on land owned or managed by outside investors, with the biggest players being PSP, the US teacher’s pension fund TIAA and the Canadian insurance company Manulife, through its Hancock Natural Resource Group division.

Bloomberg found that these companies are well aware that water in the area is drying up. But the short-term profits they can generate producing almonds and other high-value crops trumps any losses that they might incur when the water runs out.

“Deeper pockets, deeper wells. That’s what’s basically going on here,” says Ralph Gutierrez, a local water manager. “Whoever is doing this doesn’t give a damn about the small people.”15

In the neighbouring state of Arizona, a US-based financial company set up a US$430 million fund to acquire over 5,000 ha of land sitting on top of a critical water table in a low-income county in 2013. The fund then rented a large portion of the land to the UAE-based agribusiness company Al Dahra which pumps water from the aquifer to produce alfalfa for export back home. People have been campaigning against the farm because of its impact on the state’s scarce water sources, and the farm is already affecting the ability of local residents to fill their wells. But it wasn’t until August 2023, that residents learned that Arizona’s own public pension fund was the largest investor in the fund, alongside pension funds from New York City teachers and union workers in California and Michigan, thanks to reporting by the news site Reveal.

“It makes me angry, you know. It’s unbelievable that the state can do that with our retirement fund,” said Holly Irwin, an elected county supervisor who has been trying to stop an expansion of the farm. “I’ve been fighting for years to keep the water here, and it’s just frustrating – everywhere you look around, you know that this water is being depleted and alfalfa hay is being shipped overseas.”16

The financial players and agribusiness companies preying on the water sources of the southern US are now expanding across the border into Mexico, where the free trade agreement with the US and Canada has opened the door to private water concessions and hastened a boom in the export production of water-guzzling fruits and vegetables. Mexico, which is in a profound water crisis, does regulate water use for agriculture, but in practice there is no supervision and companies easily get away with taking as much water as they want.

The state of Jalisco, for instance, which is the country’s biggest producer of berries and one of the top for avocados and grapes, has only two water inspectors, says Eva Robles of the Colectivo por la Autonomia, an organisation working with peasant and indigenous communities in the state. “When the agribusiness companies first came to Jalisco they were buying land, but now they only rent because they know, at the rate that they are using water, it will all be gone in a few years.”17

One of the main companies behind California’s water grabs that is now moving into Mexico is the Renewable Resources Group (RRG). Described as “one of the biggest players in water that you’ve never heard of”, RRG amassed large areas of farmland over the previous decade to get valuable water rights in parched areas of California so that it could produce high-value crops, like almonds and grapes, or construct elaborate water trading schemes for its clients, like Harvard University’s endowment.18

In a 2018 prospectus, RRG said its strategy in Mexico is to “monetise” water through the production of “high value-added specialty crops”. By 2018, it said it had acquired over 100,000 ha of agricultural lands in Mexico, the US, Chile and Argentina, as well as private water rights in the US, Chile and Australia, generating annual returns of over 20% for its investors, which include pension funds, private equity funds, insurance companies and wealthy families.

“Competition is fierce for a scarce resource. The various competing uses for water mean that there are considerable benefits to managing water resources as a valuable economic resource and allocating water for its highest use-value. In many cases, this highest use-value is agriculture, particularly permanent specialty crops where water can be monetised through a high value product,” states the prospectus.

RRG’s strategy is to use multiple subsidiaries in Mexico to buy up lands or rent them on long-term leases, in order to get around legislation that limits the total amount of land that a single company can own. It also says it will focus on “intensive crops” that require little land but lots of water, as it is confident it can find ways around restrictions on the latter.

“RRG understands that water use is not only determined by water rights laws, but is also greatly affected by stakeholders and local politics. RRG teams know how to navigate such politics,” says the prospectus.19

Beyond Mexico, RRG has bought up several of Latin America’s top fruit producers in key irrigated, export production zones and integrated them into its new subsidiary, Frutura.20 One of these is Chile’s largest table grape producer and exporter, Subsole, with over 1,300 ha of irrigated lands.21

This move comes as Chile’s entire farm sector is in the throes of a water crisis. Over the last decades, Chile’s fruit exports have soared thanks to free trade agreements and a privatised water system established under the Pinochet dictatorship, which has allowed big fruit farmers to capture key sources of water. A handful of Chilean companies and families have made bundles of money converting their private water rights into exports of high value crops like grapes and avocados, at the expense of the communities dependent on the same water sources for farming and living. All of Chile’s fruit producing regions are now struggling with water shortages, made worse by climate change induced droughts. Yet this has not scared off RRG or other investors, like the US pension fund manager TIAA, which has recently been buying Chilean cherry farms.22 A Chilean farmland fund manager estimates that institutional investors have acquired at least 15,000 ha of farmland for export fruit production in the past two years – equivalent to a third of the country’s area planted to table grapes, Chile’s most exported fruit.

Ironically, RRG is investing in Chile through a USD900 million fund called the Sustainable Water Impact Fund that it established with The Nature Conservancy and commitments from Goldman Sachs and several US foundations. Although the fund is supposed to make investments that conserve water, it has been buying up lands for irrigated avocado and grape farming in water-starved export agriculture zones, such as the Valparaiso region of Chile and the Ica Valley of Peru.24

Harvard University’s USD50 billion endowment is also investing in the same areas. Harvard began acquiring massive areas of farmland across the world around 2010, with a particular focus on soybean production in Brazil’s Cerrado. Financial losses and public condemnation of the deals led it to spin-off its farmland division into a separate private equity firm called Solum Partners in 2020.25 That company now manages agricultural investments for Harvard, and has pivoted away from large farmland deals towards acquisitions of companies with access to irrigated water and smaller land areas for the production of avocados, berries and other high value crops in Africa, Europe, Latin America and the US. In Chile, Solum is investing in avocados through subsidiaries which have over 3,400 ha of irrigated plantations.26 The surging production of avocados, which require over 1,200 litres of water to produce a kilo of fruit, is a leading driver of the water crisis in Chile’s countryside.27

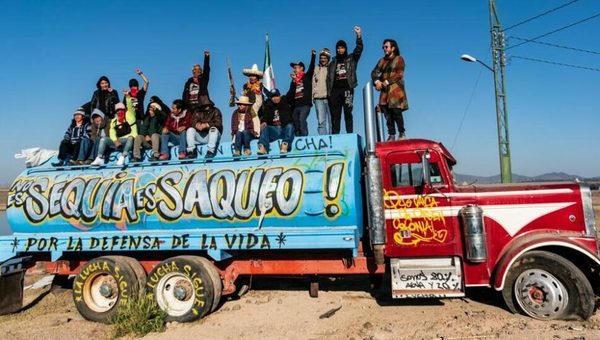

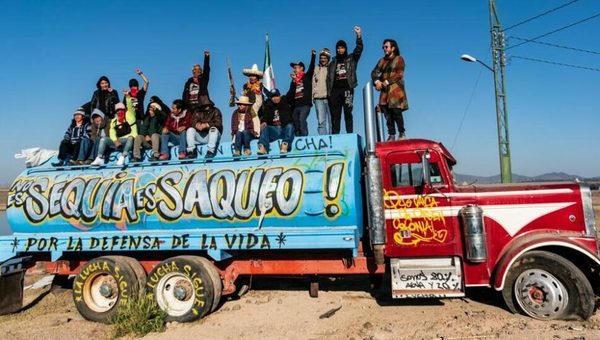

“No es sequia, es saqueo!”

The community of San Isidro in the state of Jalisco, Mexico, has been struggling for over 80 years to gain access to the collective lands it was granted under the Mexican Revolution. In a major breakthrough, the Mexican government ordered in June 2022 that one of the companies now occupying their lands, the US corporation Amway, had to give them back the 280 hectares that it acquired illegally.28 While only a portion of these lands has so far been returned to them, the community has already started planting local crops. But they are coming up against another major problem: they don’t have access to water. All of the community’s traditional water sources have been seized by Amway and the other agribusiness companies growing vegetables, grapes, berries and avocados for export in the area, leaving them without enough for their household needs, let alone to grow their food.29

” It’s not drought, it’s looting. For the defense of Life” Photo: Alternativa Socialista – Mexico

” It’s not drought, it’s looting. For the defense of Life” Photo: Alternativa Socialista – Mexico

San Isidro faces what a growing number of communities around the world are facing, as water-thirsty industrial farms contaminate their lands and drain their territories of water. People not only lose access to water, but also to food, as the industrial farms produce only for export. Many end up with little choice but to work on the farms for poor pay and under harsh, precarious working conditions, especially for women.30 The heavy use of plastics and chemical pesticides and fertiliser on the farms also have devastating impacts on people’s health and their environment.

Ironically, the corporate farms boast of their water efficiency. They utilise the latest in drip irrigation and other “smart” technologies. One technique is to fill enormous water reservoirs next to the farms to capture water during the wet season to reduce the reliance on uptake during dry periods. But none of these technologies can make the production of water-thirsty crops sustainable. The farms are designed to export water, and always at a faster rate than can be replenished. Inevitably, the loss of water leads to environmental destruction and conflicts with other users who are deprived of access.

In March 2023, more than 25,000 people gathered in Marais Poitevin, the second largest

wetland in France, for an international mobilisation against water grabbing at the construction site of one of the world’s largest agriculture water reservoir projects. The protestors came with a clear message: water grabbing for a model of agriculture “that crushes farmers and destroys ecosystems” must stop. They blamed decades of industrial agriculture for the depletion of water in the area and dismissed the mégabassines as a means to protect the “suicidal” production of water-thirsty crops for animal feed by a few large farmers to the detriment of the environment and the much needed and sustainable production of local foods by small farmers. Referring to similar protests in Latin America against water grabbing for industrial farms, they stated: “No es sequia, es saqueo!”31

The French government reacted by banning the demonstration and deploying more than 3,200 armed police. More than 5,000 grenades were fired at the demonstrators in less than 2 hours (i.e. one grenade every two seconds), injuring and maiming nearly 200 people, several dozen of them seriously. The French government then declared the main movement behind the protests, Soulèvements de la terre (Earth’s Uprising), illegal.32

Much like the community of San Isidro in Jalisco, and other indigenous and peasant communities around the world, the protestors in France believe that water should be managed collectively and that it cannot be separated from land and treated as a financial commodity to be captured and extracted by agribusiness. This international opposition to the privatisation of water, also extends to protests against water grabbing for mining, industrial uses and bottled water.

It is significant that the protests against the privatisation of water in France took place as the country’s unions were leading a massive mobilisation against reforms to the country’s pension system that were also seen as a step towards privatisation. Unlike the financialised pension systems in Canada, the UK or the US, France’s retirement system is not in the hands of the financial sector, and therefore not fuelling the global water grab for export agriculture.33

In these two movements, then, we can see a way out of the water crisis: collective control over the flow of water and collective control over the flow of money. Struggles against the privatisation of water and the privatisation of retirement systems are intimately connected. In the brutal reaction of the French state to both movements, we can see how difficult these necessary struggles will be.

Table 1

|

Some financial companies making water-led farmland acquisitions

|

|

Asset manager

|

Some recent water-led farmland acquistions

|

Investors

|

|

ADQ (UAE)

|

Fresh fruit and vegetable farms in Italy, Spain, Argentina, Chile, Ecuador, South Africa and the Philippines through acquisition of producer (Unifrutti)

|

Sovereign wealth fund for the Government of Abu Dhabi

|

|

Alantra (UK)

|

Berry farms in Spain and Morocco through purchase of major stake in producer (Surexport)

|

Spanish and European development banks.

|

|

Solum Partners (US)

|

Fresh fruit and vegetable export producers with farms in Chile, Peru, Mexico, Spain, South Africa and Mozambique.

|

Harvard University endowment and the insurance company AIG

|

|

Manulife (Canada)

|

Nut farms in the US and a major fruit exporter in Chile (David Del Curto)

|

Numerous pension funds, via Hancock division

|

|

Macquarie (Australia)

|

Crop farms with water rights in the Murray-Darling Basin area.

|

Mainly pension funds, including Pension Fund of Japanese Corporations

|

|

Ontario Teachers’ Pension Plan Board (Canada)

|

Almond and avocado farms in Australia

|

Pensions of teachers in Ontario, Canada

|

|

Paine Schwartz (US)

|

Berry farms through a take-over bid for the Costa Group, which has farms in Australia, China and Morocco

|

Mainly US pension funds and state sovereign wealth funds.

|

|

PSP Investments (Canada)

|

Crop farms with water rights in Australia and the US, and fruit farms directly or through the acquisition of producers with farms in Chile, Peru, Mexico, Morocco, Spain and the US

|

Pensions of public workers in Canada.

|

|

Renewable Resources Group (US)

|

Farms and farming companies to produce table grapes and berries in Chile, Mexico, Peru and Uruguay

|

Pension funds, insurance companies, foundations and wealthy families

|

|

Nuveen (US)

|

Nut farms in the US and farms to produce cherries, grapes, nuts and avocados in Chile

|

US teachers’ pension fund TIAA and other pension funds from the US, Canada and Europe.

|

|

source: GRAIN

|

Table 2

|

Some PSP Investments land deals for water

|

|

Deal

|

Water access

|

|

Cotton in Australia

|

|

|

Almonds in the US

|

|

|

Lemons in Spain

|

|

|

Berries around the world

|

in 2023, PSP became a controlling shareholder of the Chilean berry producer Hortifrut, which has over 4,000 ha of intensive irrigated farms in Argentina, Brazil, Chile, China, Mexico, Morocco, Peru, Spain and the US.

|

|

Almonds in Australia

|

|

|

Fruits in the US

|

|

|

Walnuts in Australia

|

|

|

Tomatoes in Canada

|

|

|

Dairy in New Zealand

|

|

Photo: Apr 14, 2009 – Firebaugh, California, USA – Led by the California Latino Water Coalition, thousands of farmworkers, farmers and area politicians began a four day march Tuesday to call attention to the lack of water allocations to Central Valley farms. Above, the march straddles an irrigation ditch on a farm near Firebaugh in western Fresno County. ZUMA Press, Inc. / Alamy Stock Photo